Curriculum

INTRODUCTION TO ISLAMIC SACCO -JULY/AUGUST

Module 1: Fundamentals of Islamic Finance

0/8Module 2: Products of Islamic SACCOs

0/2Module 3: Shariah Governance in Islamic SACCOs

0/2Module 4: Creation of Islamic SACCO Window

0/1ASSESSMENT

0/1Asset Products in Islamic SACCOs

1. Introduction

Asset Products of Islamic SACCOs are all activities through which they create liabilities upon their customers. These ativities are based on a variety of Shari’ah commercial contracts such as Murabaha, Tawarruq, Musharakah, Mudharaba, Ijarah, Wakala among many others. At this point therefore, it is essential to differentiate between products and contracts. Simply, a product is what serves the customer’s needs, while a contract is what serves the need of a product. All prodcuts must be backed by an underlying Shari’ah contract. Nevertheless, several Islamic Shari’ah can be suitable for a single product.

2. Products of Islamic SACCOs

There are three categories of products in Islamic SACCOs: Asset products, Liability products and Service products. As we shall discuss liability and service products in the liability products side, below is a summary discussion of the asset products of Islamic SACCOs:

2.1 Asset products

Asset products include customers’ needs for: (1) Working capital to support day-to-day business activities (2) Land or house purchase /construction/improvement (3) Auto finance for motor vehicle purchase (4) Loan Take overs (5) Personal finance to carter for medical bills, school fees, dowry, etc. Just as stated earlier, these asset products must have underlying Islamic contracts such as sale based contracts, equity based, hybrid, lease and charitable ones as follows:

2.1.1 Sale based

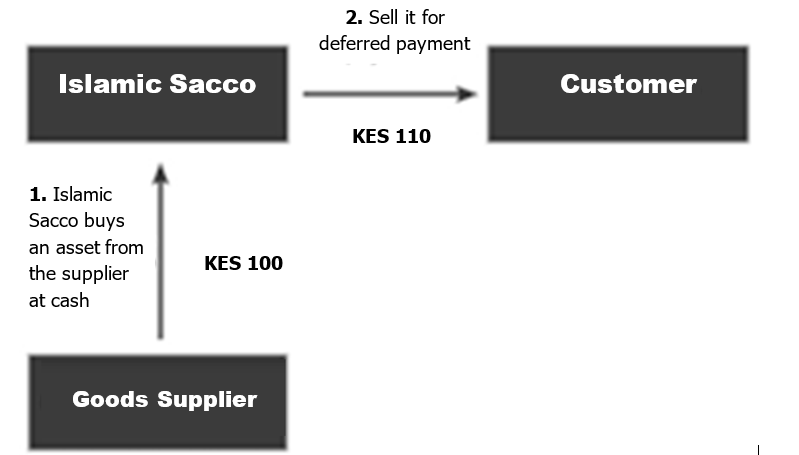

A. Murabaha (Cost plus profit)

Murabaha contract is used by Islamic SACCOs where the customer cannot contribute anything to purchase goods or services. These include auto finance, home appliances finance, land finance, construction materials, stock purchase. It also includes purchase of non-tangible assets such as rights and royalties of halal nature, as they have value, are owned and can be sold on credit. Services can also be sold through Murabaha by the service provider himself. However, if they are to be purchased from a third party, then it is recommended to use service Ijara as the underlying commercial contract.

Currency or monetary units cannot also be sold through murabaha, because currencies are subject to the rules of Bai al Sarf (currency exchange) which requires that they should be exchanged simultaneously and without delay, in addition to the requirement that currencies of the same type should be equal in value.

The member is required to repay the cost price plus the mark up of the SACCO. The payment may be in cash (spot) or deferred, either in a lump sum at a future settlement date or in specific monthly instalments. The advantage of this contract to the SACCO is that even if the customer does an early payment, the SACCO is entitled to collect all the future profit, unless the SACCO gives the member a rebate on the future profit at its own discretion. It is also an advantage to the member that in case the market profit rates change, he is only obliged to pay the initially agreed upon amount.

Steps for Murabaha financing

- The member identifies an asset to be acquired, and provides a valid invoice to the SACCO with the SACCO’s name as the purchaser.

- The SACCO is at liberty to seek from the member a security deposit called Hamish Jidiyya.

- The member then signs a Master Murabaha agreement which clearly stipulates the cost price and the profit to be earned by the SACCO.

- The SACCO purchases the asset from the owner on cash basis. In cases whereby it will be practically impossible for the SACCO to directly undertake the buying, the member will sign an agency (Wakalah) agreement, the SACCO being the principal, and the member as the agent to purchase the asset on behalf of the SACCO.

- The SACCO sells the asset to the member at a cost-plus profit on deferred basis.

- The member takes delivery of asset and pays the SACCO within agreed terms of financing as per an agreed upon repayment schedule.

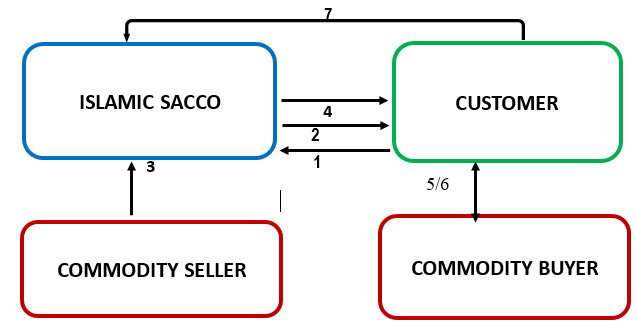

B. Commodity Murabaha (Tawarruq)

Historically, people often used to buy goods on a deferred payment basis at a higher price. They would use it for some time and then decide to sell it for cash when they no longer needed it. The price obtained was the market price and not a pre-determined price. The goods bought should be ones that can be easily traded in the market, such as palm oil, platinum, copper. Gold and silver are treated by the Shari’ah as currency and cannot be traded. Tawarruq has been allowed in Islamic finance as a variation of murabaha, but in a limited context of one-off transactions, where cash disbursement is essential for medical bills, take overs of interest based loans, school fees, personal finance for day-to-day business activities, working capital for businesses such as payment of salaries and taxes, bill encashment and discounting for corporate clients, insurance premium financing (IPF), paying debtors. It is a condition that Tawarruq should only be applied where alternative modes cannot be used to serve the needs of the members, provided it strictly complies with the Shari’ah rules of sale.

Steps for Tawarruq Financing

- The member who needs cash approaches the SACCO and promises to buy the commodity from the SACCO after it purchases the asset from a commodity broker (A).

- The request is approved

- The SACCO purchases a fast-moving commodity from a commodity platform say for KES 1000

- The SACCO sells the commodity to the member on a deferred payment basis after adding its profit margin totaling to say KES 1100.

- The member appoints the SACCO as his agent for the sale of the commodity on a cash basis to a third party.

- The SACCO sells the commodity to a third party [another commodity broker (B)] on a cash basis. The cash money that the SACCO obtains from step (6) is deposited into the member’s account with the SACCO, and as a result, the member obtains the needed liquidity.

- The member is obliged to pay the amount due to the SACCO (Principal + Profit) by way of agreed installment method.

Many Shari’ah scholars have criticized the use of organized Tawarruq by Islamic financial institutions. They have argued that Tawarruq involves sham purchases and sales of commodities which are a cover for money being made available now for more money later (interest). The Accounting and Auditing Organisation for Islamic Financial Institutions (AAOIFI), the international standard setting body based in Bahrain, has issued Shari’ah Standard No. 30 which allows Tawarruq on the ground of necessity, but only if strict limits are followed. The Standard specifically prohibits the use of Tawarruq for the benefit of a conventional bank if the Islamic financier knows the conventional bank would use the liquidity for onward interest-based lending.

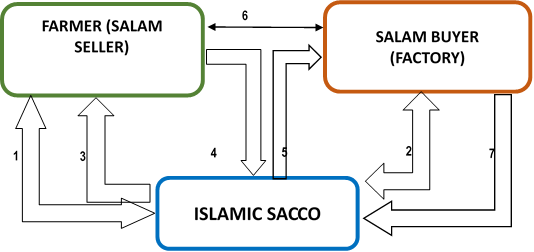

C. Bai Salam

Salam is a forward financing transaction, where the SACCO pays in advance on spot for buying specified assets from the member, which the member will supply on a pre-agreed date. What is given in exchange for the advance payment of the price should not in itself be in the nature of money.

Today, Banks/SACCOs use Bai salam to finance farmers. The farmer sells a future harvest for a spot payment by the Banks/SACCO, hence they can use the payment for purchasing inputs and working capital. At the same time, the SACCO also enters into a parallel Salam with a buyer of the harvest to which SACCO the produce will be sold upon harvest and delivery by the farmer.

Steps in Salam financing

- The facility is approved, and a Salam Contract is signed between SACCO and the farmer (member).

- The SACCO signs a parallel Salam contract with a product buyer (mostly a factory)

- The SACCO pays the farmer for goods to be delivered in future

- Farmer delivers the goods to the SACCO

- The SACCO delivers the goods to the buyer e.g. Factory

- The goods make physical movement from farmer (member) to buyer

- The Buyer/Factory pays the SACCO for the goods.

Note that in steps 4 and 5, goods change ownership constructively but actual physical movement takes place at step 6.

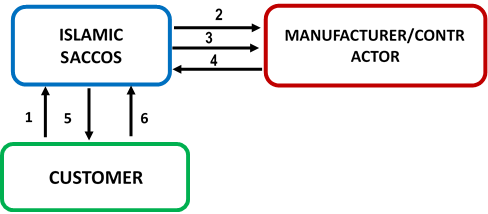

D. Istisna’a

Istisna’a is a Shari’ah contract of financing, widely used by Islamic banks/SACCOs to finance different kinds of construction or manufacture projects, such as housing, construction of buildings, plants, roads, manufacturing of aircrafts, ships, machines and equipment, etc. It can also be used for export financing as well as to meet working capital requirements in industries where sale orders are received in advance.

SACCOs may undertake financing based on Istisna´a by getting the subject of Istisna’a manufactured through another such contract. Accordingly, they can serve both as manufacturers and purchasers. However, Istisna´a cannot be used for natural things or products that are not manufactured, such as animals, fruits, etc.

Steps in Istisnaa financing

- The member orders for construction of the house

- The SACCO pays a contractor (Cost Price)

- The SACCO commissions construction

- The manufacturer delivers the house to the SACCO

- The SACCO delivers the house to the member

- The member pays the SACCO (the Sale Price)

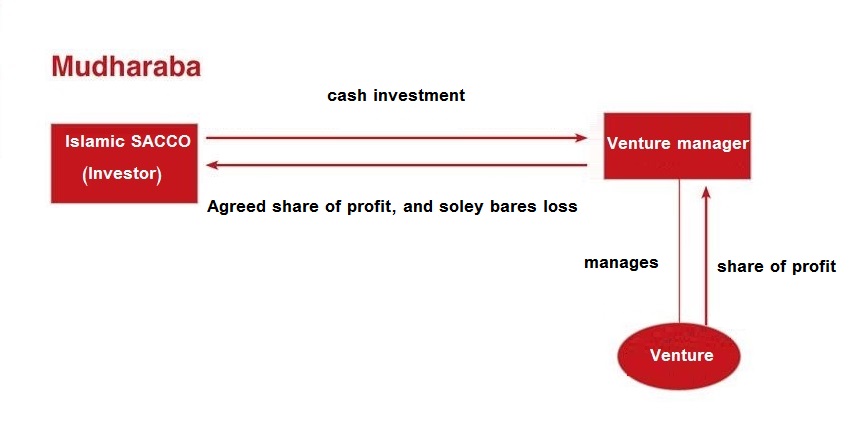

2.1.2 Equity based – Mudharaba

Under Mudarabah commercial contract, the SACCO and the member enter into a profit sharing agreement, where the Islamic SACCO provides the capital to a menber who wishes to take part in a business venture, while the customer provides labour and entrepreneurial skills to manage the business; in case of any loss, it is borne solely by the Islamic SACCO, while profit is shared between the parties in accordance with a pre-agreed ratio. Mudharaba can be used by SACCOs to finance member’s new or continuing businesses. They can also use Mudharaba to invest their surplus liquidity with other SACCOs or banks under fixed maturity accounts

Steps in Mudharaba financing

- The SACCO approves a facility and enters into Mudharaba agreement with the member, or another SACCO or a bank.

- The SACCO releases the funds to the member’s account held at the SACCO, while the member puts in the expertise or entrepreneurial skills, and both agree on a profit-sharing ratio.

- Profit, if any is shared according to the agreement, while in normal circumstances any loss will be borne by the rabbul-maal (the SACCO), while the agent or manager (member) loses the share of the expected profits that would have been received as compensation on account of the labour and effort invested in the failed business.

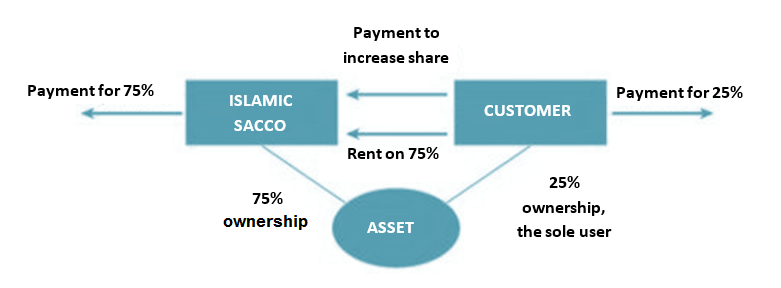

2.1.3 Hybrid based – Musharakah

There are two types of Diminishing Musharakah used by Islamic financial institutions. In the first one, called Diminishing Musharakah (DM), the asset matter is bought by both the SACCO and the member from a third party, while in the other one, called Diminishing Musharakah Sale and Lease Back (DM S&L), the SACCO buys part of an asset (such as a house, land or machine) owned by the member to acquire a share in it, so as they both become partners in its ownership. In both arrangements, the client is normally the sole user of the asset, hence utilizing both his shares and the shares of the SACCO, hence entitling the SACCO to a rental on its shares at an agreed upon rate. Musharaka is used by SACCOs to finance members who need goods or money as in the below process.

Steps in Diminishing Musharakah financing Process

- In the case of DM, a member who wants to buy an asset, gives a clear and proper description of the asset through an invoice, while in DM S&L, where the member is the owner of the asset, he also provides title documents to the asset.

- In case of asset finance (DM), the member presents to the bank evidence of his contribution if already paid, and signs a Letter of Offer (LOO) which includes the following documents: (1) Master Musharakah Agreement (2) Undertaking to purchase Sacco’s shares (3) Agency Agreement to enable him act as an agent of the SACCO in maintenance of the asset (4) Repayment schedule showing the monthly instalment to be paid, which comprises of principal amount plus profit (rental). In the case of DM S&L he also signs a purchase agreement through which the SACCO buys a share of an asset owned by him.

- In the case of DM, the SACCO pays its share directly to the dealer by disbursing the funds in the member’s account (for record), then sends them to the vendor through RTGS, SWIFT, EFT or through any other means of funds transfer, while in the case of DM S&L the cash is not transfered from the member’s account, as he is the one in need of them.

- The member starts paying monthly instalments comprising of principal (buy out) and profit (rental). Through the principal, the member buys the share of the SACCO, buying out the SACCO, and at the end of the term, the member becomes the sole owner of the asset.

2.1.4 Lease based – Ijarah

Ijara is a leasing contract under the asset products, where (in a financial lease) the SACCO leases its asset to a memebr for an agreed-upon price over a fixed period of time, and the member takes ownership of the asset in the end. In Ijara, the asset to be leased must be in existence at the time of signing the contract. Islamic SACCOs commonly use Ijarah as a financial lease (ijarah wa iqtina), where the leased asset is first purchased by the Islamic SACCO, and may be sold to the lessee (member) at the end of the lease period.

So long as the asset is on lease, the SACCO as lessor owns both the risk and reward of ownership and, thus a SACCO will require to first purchase the asset in question and then lease it to the member for an agreed rental, the duration of the lease, as well as the basis for the rental, are set and agreed in advance.

Steps of Ijara financing

- You identify the asset that you wish to purchase/own.

- You enter in a lease/Ijarah agreement with the SACCO for the said asset/property, pay the security deposit for the asset and promise to lease the asset from the SACCO after the SACCO has acquired it.

- The SACCO pays the seller for the asset/property.

- Seller passes ownership of the asset/property to the SACCO.

- SACCO leases the asset/property to you.

- You pay Ijarah rentals over agreed period.

- At end of the leasing period, the SACCO sells the asset to you at the agreed sale price or can give you for free as Gift (Hiba)

NB: The above is in cases of Ijara wa iqtina (financial lease). If however the contract is not a finance lease, then the contract ends at the end of lease period and the SACCO takes charge of the asset/property once again. However, the understanding in the Banking and SACCOs sector is that the final owner is the member.