Curriculum

INTRODUCTION TO ISLAMIC SACCO -JULY/AUGUST

Module 1: Fundamentals of Islamic Finance

0/8Module 2: Products of Islamic SACCOs

0/2Module 3: Shariah Governance in Islamic SACCOs

0/2Module 4: Creation of Islamic SACCO Window

0/1ASSESSMENT

0/1Liability and fee Products in Islamic SACCOs

1. Introduction

Front Office Service Activity (FOSA) is the deposit side of SACCOs, where members deposit their money for banking services. These deposits are collected through several Islamic Liability based products such as current accounts, saving accounts, transactional accounts among many others, by use of various Shari’ah contracts like; Qardh, Tawarruq (Commodity Murabaha), Mudharaba, Musharakah and Ijara. SACCOs also render a number of fee (service) based products such as funds transfer, debit and credit cards, ATMs services, investment management and advice, foreign exchange etc.

2. Liability products

2.1 Current accounts

Islamic SACCOs mobilize deposits from account holders of current accounts based on the principle of Wadiah or Qardh. In both Wadiah and Qardh, the SACCO is deemed as a keeper and trustee of funds, and has the depositors’ permission to use the funds for its operations in a Shari´ah compliant manner, and the SACCO guarantees refund of the entire amount of the deposit, while these deposits can be withdrawn at any time, and the depositors have no right to any return/profit on such deposits.

2.2. Savings and Fixed Maturity accounts

Islamic Saccos also mobilize deposits through Mudarabah, which is one of the profit sharing (PS) modes in Islam. It takes the form of a partnership contract, where one party (Rabbul-Maal) provides capital, while the other (Mudharib) provides labour and entrepreneurial skills to manage the Shari’ah complaint business; and in case of profit, distribution amongst the depositors and the shareholders is made according to the weightage assigned usually at the beginning of each month to their investments. And in case of loss, it is borne solely by the capital provider (the depositor). However, according to the guidelines of Central Bank of Kenya, financial institutions are required to guarantee the depositors’ money from any loss, hence it does not allow loss sharing. Loss sharing is also not allowed under Islamic Law in case the manager of the fund (the Sacco) is proved to have done a fraud, negligence, or breach of contract.

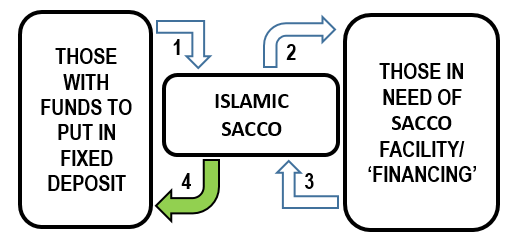

Mudharaba Deposits Mobilization process in Islamic Saccos

- Those with excess funds come to the Sacco and place the funds under a Mudharaba agreement, and agree on the profit-sharing ratio. Some Saccos give a 6% p.a return of the profit.

- The deposits are placed by the Sacco in a Mudharaba pool, which has a number of categories depending on the period (term) and capital invested. The categories are given weightages in order to strike a balance on the terms and amounts deposited, because KES 1,000,000 deposited for say one month is not equal to KES 1,000,000 deposited for say 3 months.

- The Sacco receives a return/profit from the financed customers based on the contract, performance and the agreement.

- The Sacco pays deposit owners profit based on the contract, performance and the agreement.

3. Fee based Products

3.1 Agency services

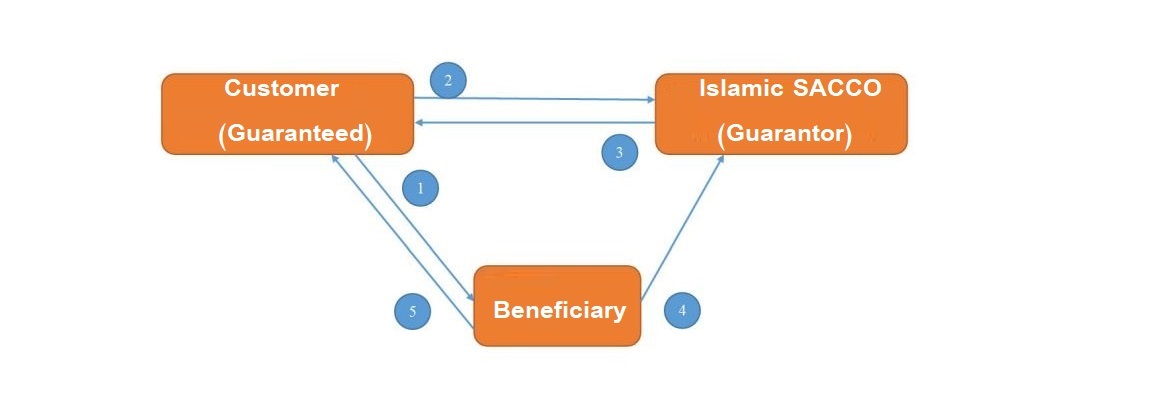

Steps for guarantee

Steps for guarantee - The member approaches his/her Islamic SACCO to request the issuance of Guarantee facility.

- Islamic SACCO issues Kafala to the member, as a surety to discharge the liability of beneficiary in case the member defaults. In return, a sum amount of fee is charged to the member.

- In the event of default by the member, the beneficiary will claim from Islamic SACCO, and the Islamic SACCO makes immediate payment on first demand provided the claim meets all the conditions of the guarantee.

- If there is no default, the beneficiary will return the kafala to the member followed by Islamic SACCO’s cancellation upon maturity.