Curriculum

INTRODUCTION TO ISLAMIC SACCO -JULY/AUGUST

Module 1: Fundamentals of Islamic Finance

0/8Module 2: Products of Islamic SACCOs

0/2Module 3: Shariah Governance in Islamic SACCOs

0/2Module 4: Creation of Islamic SACCO Window

0/1ASSESSMENT

0/1Creation of Islamic SACCO Window

1. Introduction

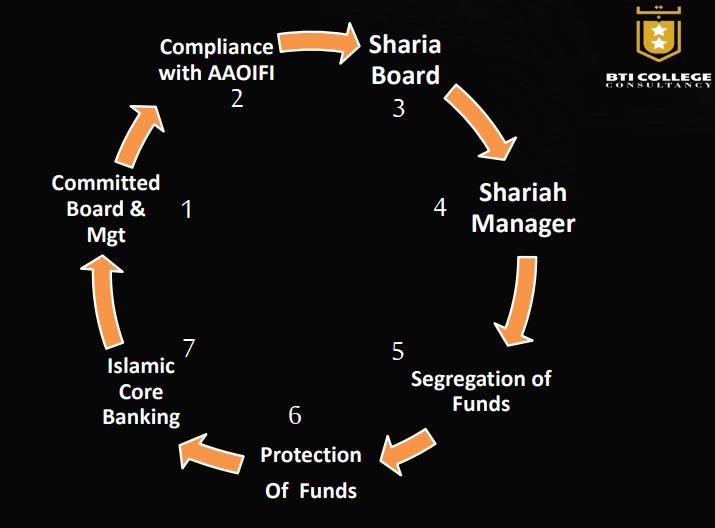

An Islamic Window is a Shari’ah compliant department of a conventional financial institution. For SACCOs and their windows to be Shari’ah compliant, they have to meet a number of requirements; the most important of them being: (1) complete segregation of funds, (2) the existence of a Shari’ah Supervisory Board (SSB), (3) management committed to Islamic financial concepts, (4) safeguarding Muslim investors’ funds from negligence, trespass and fraud (5) compliance with the standards of the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI), and (6) Islamic core banking system, as summarized below:

2. Requirements for creation of Islamic SACCOs and windows

2.1.Managerial Commitment

The financial institution’s management, which is undertaking such business activities, should be fully convinced of the concept and fully committed and dedicated to it. It should be anxious to implement it and comply with the teachings governing it. Unless the entire management is committed and convinced, the business activities and the enterprise will not be fault free or will not escape irregularities and deviations. Regardless of how strict and stringent fatawa (scholarly rulings on a matter) and Shari’ah contracts are, this will not ensure sound practices if there is no one sufficiently sincere and committed to implement the principles. However, there is no harm in starting first with the executive senior management, which implement resolutions and subsequently trains the other members of the administrative team. The general manager himself should act as a springboard and set a good example for all in this respect.

2.2 Complete Segregation of Funds

The funds of the Islamic window and those of the conventional financial institution must be completely segregated. This means separation of accounts and operations. Funds collected from investors must be kept in accounts that have shari’a compliant features, and must be invested in shari’a compliant transactions. This is in achieving the wish of investors who are very diligent and anxious to earn lawful income, who wouldn’t like the income generated from their investment to be commingled with those of conventional investors who are not observant of the Shari’ah. Therefore, there should be separate accounts, transactions, books, and computer programs evidencing this complete segregation of funds utilization. This matter is not difficult or problematic in view of the availability of modern computer systems, assuming that intentions are sincere and the required expertise is available. This compliance should be enshrined and expressly stated in the statutes or the Memorandum and Articles of Association.

There is a misconception that the separation of funds/deposits should be physical, and that funds especially in Islamic windows should be in separate vaults from the conventional deposits. That’s not the case as we have elaborated above.

Additionally, the mother SACCO and the Islamic window are totally two different entities, hence from the ahkam (Islamic legal rulings) point of view, there is no prohibition of the window borrowing through a shari’a interest free loan from the mother SACCO, because money that is haram to one person, it is not haram to another person who did not aid in acquiring it through illegal means. In fact, it is purely halal to him when he acquires it from him through shari’a acceptable means.

2.3. Shari’ah Supervisory Board (SSB)

There should be a Shari’ah Supervisory Board (SSB) for Islamic windows, and that Board should consist of trustworthy scholars who are highly qualified to issue fatawa (religious rulings) on financial transactions. In addition, they ought to have considerable experience with knowledge of modern dealings and transactions. The Articles of Association, prospectuses, or statutes (depending on the type of activity) should provide for the existence of a Shari’ah board, whose fatawa and resolutions should be binding upon the financial institution. It should be independent and free to give opinions on proposed contracts and transactions. The role of the Shari’ah Supervisory Board should be concurrent with that of the financial institution itself in the sense that it should be formed from the moment the financial institution is incorporated, and that it should provide continued supervision and permanent checking of contracts, transactions, and procedures. This should be expressly provided for in the Articles of Association or the prospectus.

Due to the fact that the Shari’ah Supervisory Board members cannot be the ones ensuring the daily compliance of the SACCO, it is upon management to employ an internal Shari’ah department which comprises of a manager, Shari’ah compliance officer and a Shari’ah auditor. As the two officers report to the Shari’ah manager, the compliance officer should ensure daily activities and processes are Shari’ah compliant, while the audit officer does a periodic check on whether the processes were conducted in accordance with Shari’ah.

2.4. Safeguarding Muslim Investors’ Funds

It is an established principle in Islamic law that the investment manager (mudarib) does not guarantee the mudaraba capital for the capital provider. Hence, investment accounts in Islamic SACCOs are not guaranteed by the mudarib (the SACCO). However, this does not prevent the laying down of a stipulation requiring that the parent conventional financial institution (the original company) guarantee Muslim investors’ funds against trespass, negligence, and fraud. Major financial institutions may sometimes shirk their responsibility in this connection by claiming that their Islamic windows, branches, or sections are privately incorporated, among other reasons and excuses. This is wholly unacceptable. Precautions should be taken to guard against this, and a similar policy should be expressly stated in the Articles of Association or the prospectus of the institution.

2.5. Compliance with AAOIFI Standards

The Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) has issued and published a number of accounting and auditing standards that all Islamic financial institutions should comply with and implement. The AAOIFI’s activities are considered a fundamental groundwork that underpins Islamic banking activities by keeping them away from individual, personal reasoning. The collective personal reasoning (ijtihad) of the AAOIFI is highly important in this vital aspect of Islamic economic life. Therefore, these standards deserve strict adherence. A number of government authorities and central banks in certain countries have circulated these standards and obliged other financial institutions to comply with them. That is why any party wishing to incorporate or set up an Islamic financial institution should be required to conform to these standards in order to avoid confusion, misunderstanding, and ambiguity, and to seek clarity and sound business activities.

Islamic financial institutions and windows are also required to make sure that their by laws and policies are in line with Islamic law.

2.6. Islamic core banking system

The SACCO should install and core banking system that is in line with principles of Islamic finance, which classifies products under their correct Islamic contracts, and which enables all transactions to be shari’a compliant.

3. Start-up capital for Islamic windows

An Islamic financial window can get a loan from the parent institution to start its operations on Qardh Hasan (interest free loan) basis, or any other shariah compliant manner. This is based on the fact that money in itself is not haram, but the manner in which it is lent or borrowed. The Prophet ﷺ used to borrow from jews in Madina, and even died without repaying all his debt which was secured by a mortgage.

What matters in Shari’ah compliant transactions is the transaction between the two transacting parties; hence the transaction between the parent Bank and the Shari’ah compliant window should be in line with the Shari’ah principles.

Some windows even start by converting accounts owned by Muslim customer or customer professing any religion whose nature of business is halal with their consent. This deposits are then used as the starting capital.

In addition, it has to be noted that the customer’s deposits in the conventional SACCO are not haram, even if the their sources are haram. This is because in most cases, SACCOs mobilize them through loans, which become lawful to them, while the burden of illegality remains on the depositor. The haram thing is what the bank or SACCO does with the money i.e. using the deposits to lend at interest. Having said so, it is worth to note that from the Maqasid (objectives of shari’a) point of view, it is not recommended to take deposits from customers who do illegal activities just to help them cease from such dealings.

4. Existence of Islamic SACCOs

Islamic SACCOs exist in different forms, most common of them being: fully fledged, windows, subsidiaries and Islamic services offered by conventional financial institutions not under an Islamic window.

All these forms must abide by the requirements of operating an Islamic financial institution/window except the requirement of segregation of funds which only applies to windows and subsidiaries.

5. Products development of Islamic SACCOs

5.1 Idea generation and market research

It is the first stage of the product development process. Ideas can be taken internally through brainstorming, or externally through magazines, competitors and necessities of customers.

This is followed by a market research in order to evaluate the strengths and weakness of such a product.

5.2 Coining the product’s features

This helps in ensuring that the needs assessed will be fully satisfied by the main features of the intended products.

5.3 The Shari’ah desk and shari’a board

The product having been presented to the Shari’ah manager, and having studied it and be well satisfied with its compliance, it is presented to the Shari’ah board for review and consideration. It should be noted that it is not the obligation of the Shari’ah team to develop products. Its role is only to guide in regards to its shari’a compliance or not.

5.4 Testing and Launching

When the teams are satisfied with the product, it is launched to the public so as to satisfy it intended goals. And in case the team is not satisfied, then the product may be rejected and subjected to any corrections required before it’s launcher.

Congratulations for successfully completing this course.